ROC (Registrar of Companies) Annual Compliance means filing certain returns and documents every year with the Ministry of Corporate Affairs (MCA) — even if your company had no business activity.

It’s a mandatory legal requirement for all registered companies in India — whether Private Limited, OPC, or LLP.

Why is ROC Compliance Important?

- Legal Requirement – Avoid penalties and maintain good standing with MCA

- Builds Trust – Helps in building credibility with banks, clients & investors

- Avoid Striking Off – Non-filing for consecutive years may lead to company strike-off

- Saves Penalties – Late filing can cost ₹100 per day, per form!

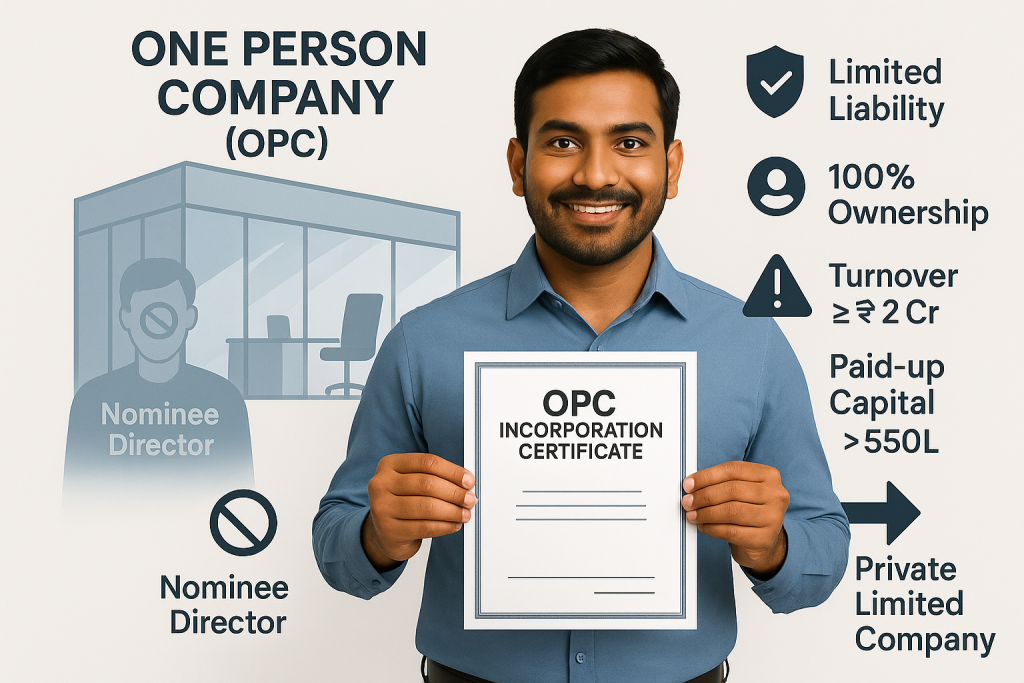

Key ROC Filings (For Private Limited/OPC)

| Form | Purpose | Due Date |

| ADT-1 | Auditor appointment | Within 15 days of AGM |

| AOC-4 | Filing of financials | Within 30 days of AGM |

| MGT-7 | Annual return | Within 60 days of AGM |